S. is the fact that it allows consumers take-out money and you can handmade cards totally due to mobile

However, Onur Genc, the fresh president and President regarding BBVA Compass within the Birmingham, Ala., as January, has delivered 4 mil pieces of direct mail encouraging their bank card consumers to help you consolidate the large-interest-rates credit personal debt toward a less costly on line financing product named the newest Express Consumer loan. It deal an apr between six.07% and you may % predicated on creditworthiness, amount borrowed and you can label size.

Over 50% from Guaranti users have fun with electronic financial one or more times a month, and you will thirty-two% of bank’s products are marketed due to electronic streams

The common customers could save hundreds of dollars by firmly taking advantage of offer, and this raises the absolute matter-of as to why brand new $87.step 3 mil-asset bank is out of the answer to compromise money.

We are carrying out whichever is made for the client, Genc told you into the a job interview recently. In the event that all of our credit card people re-finance during the less price, we’re Okay with this because they’re however banking with united states, therefore our very own dating will be bolstered. … We are really not in the market out of delivering an individual device. We are on the market of bringing a relationship, and then we need certainly to extend one to matchmaking.

Genc’s plan is partly reality – Whenever we dont give this to the individual consumers, we’re sure might have it off somewhere otherwise, he told you – and you can partially a gamble one to a consumer-centric, digital-heavy means are certainly more financially rewarding finally.

Additionally it is a typical example of a great maturation techniques from inside the digital financial, told you Mark Schwanhausser, manager out of omnichannel monetary properties at Javelin Means & Browse.

Anytime a lender says, I’m willing to consider this from the sight off what’s best for people,’ although it means placing all of them towards an integration mortgage or cutting its rates, it performs to the bank’s in addition to customer’s virtue, he said. If it’s a wise refinancing, the customer pros in addition to financial provides the consumer. Therefore begins to introduce research that the bank is acting such as a good fiduciary.

Permitting bank card consumers toward cheaper financing means strengthening a lengthier title dating, not merely racking your brains on ideas on how to optimize focus or income for another quarter, Schwanhausser told you.

For the Javelin’s latest online and mobile financial scorecards, the financial institution was a leader inside on the web financial exercise and mobile comfort.

Alternatively, there are certainly others having and additionally nudged a tiny high within the overall investigations of customers experience, Schwanhausser said.

Genc’s motto are winning growth one stems from personnel and you will buyers satisfaction, including digital innovation. All of our people strategy is which our anybody is to have more confidence doing work in regards to our financial, they should be happy with working right here, he said. Except if these are typically happy, clients are maybe not likely to be delighted.

Managers’ efficiency recommendations will hop over to the web site be based to some extent on the employee involvement, so they have to make sure our workers are involved as to what they actually do, Genc said. Which is how exactly we perform top customer care.

Every movie director scorecard will reason behind the new bank’s net promoter score, hence shows this new portion of users who recommend the bank to help you other people.

So you can foster business development in twigs, buyers feel professionals which until now has actually trapped strictly to service will quickly begin providing the Display Consumer loan in order to customers.

We have a device, an individual would love to have that equipment since they are heading to blow much less to your credit card debt, Genc said. The customer experience professionals have there been. Why won’t it share with the customers that we understand this high tool?

His record has been in the technical – he analyzed electricity technology for the Turkey, up coming went to Carnegie Mellon University into the Pittsburgh where his first employment is programming application to possess faculty indeed there.

When he is deputy Ceo in the Guaranti Lender in the Turkey, Genc produced a name getting themselves into the electronic invention and you may sales.

BBVA Compass’s portion of transformation courtesy digital channels is leaner, yet it’s two-and-a-half moments the U.S. federal average, predicated on Genc. Regarding fifteen% regarding Express Unsecured loans and you can forty five% of handmade cards is actually started due to digital avenues.

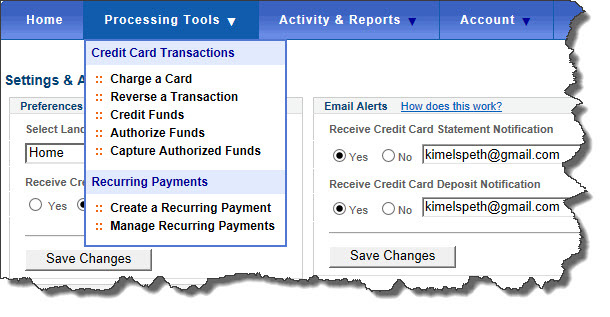

I happened to be very astonished as i arrived here and watched that electronic financing in some way is being ruled because of the fintech providers, Genc told you. I don’t just remember that ,. If you possess the customer, why should you perhaps not lay one product capabilities in your cellular software? And you may playing cards – why should you possess those who work in brand new cellular app?

BBVA Compass’s mobile app’s App Shop get was 4.8, the best among top 100 banks. Lower than Alejandro Carriles, executive vp and you can head of cellular and online financial, the newest application might have been constantly delicate and you can improved. Recently people were permitted to purchase licenses away from put from software. Another type of function lower than creativity is actually a journey and you can routing book one assists walking anybody using what they should do; this may at some point getting AI determined and you can predictive.

There are certain things Simple do which can be a great, Genc said. The NPS off Effortless is amongst the large from the You.S. banking sector. It’s 62. These are typically doing things unique so we need certainly to preserve one to community.

Regarding the digital space, selling is very important, the guy said. They need to convey more products in the latest software as well as in the brand new giving therefore, the customer will get make the most of those people due to the fact well.

A 3rd part of reaching effective gains, in Genc’s look at, is improving show on the straight back workplace, the new twigs and you may every-where otherwise compliment of redesigned processes.

In some cases, we have automated specific factors, nevertheless the means techniques has been perhaps not an enhanced procedure, he recognized. So we have to look into those people.

The newest adoption out of fake intelligence software program is an integral part of that it. AI takes care of certain chores people create now, increasing total processes.

Needless to say operational jobs, AI is already positioned, Genc told you. For example, the lending company is using automatic process automation into the anti-money-laundering conformity and you can con detection.

In just about any area, there could be space having AI, the guy told you. AI try good buzzword today, but at the end of the day its wise coding that have self-change in the new logic. You can make use of you to anywhere – into the scam, into the compliance, in the operations, all of which we have been creating, and in a whole lot more funds-generating and you can faith creating features.

The bank try trying to use AI to anticipating customers’ dollars flows, after which alerting these to things like potential overdraft charges.

An effective amount from You.S. customers are nevertheless expenses [nonsufficient finance] costs, Genc indexed. We can alert them early.

So it cannibalization thought of, Commonly we likely to get rid of several of one to funds?’ does not matter, he told you. The client wins. We must make sure we have been enabling all of them in those behavior. Which is the way we get trust.